https://fldmp.com/9Rick%20Blyth%20-%20Chrome-Ext/12-%20Exit/08-End%20To%20End%20Selling%20Process.mp4

https://fldmp.com/9Rick%20Blyth%20-%20Chrome-Ext/12-%20Exit/08-End%20To%20End%20Selling%20Process.mp4 - Part 1

The narrator sold Chrome extensions on Empire Flippers, considering them the gold standard for selling software apps. Empire Flippers offers protection for buyers and sellers and manages the entire process, including migration. They provide a valuation range using an online tool, which was close to the final selling price for the narrator.

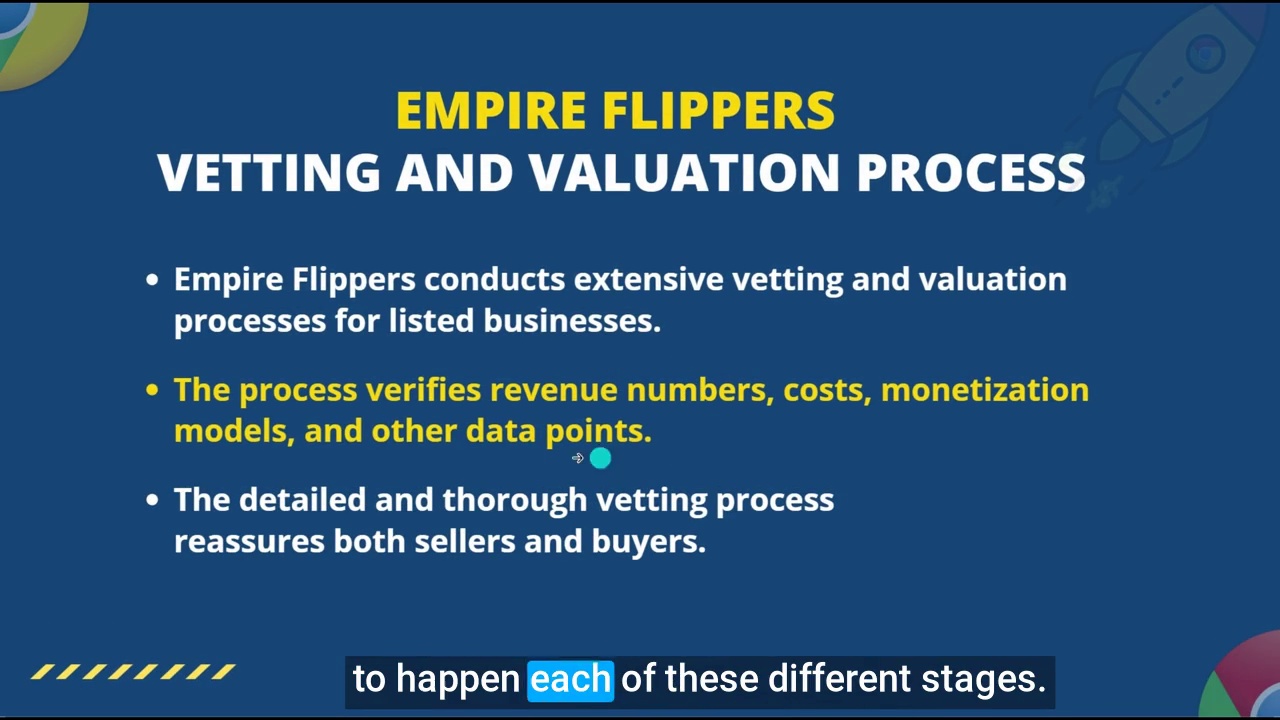

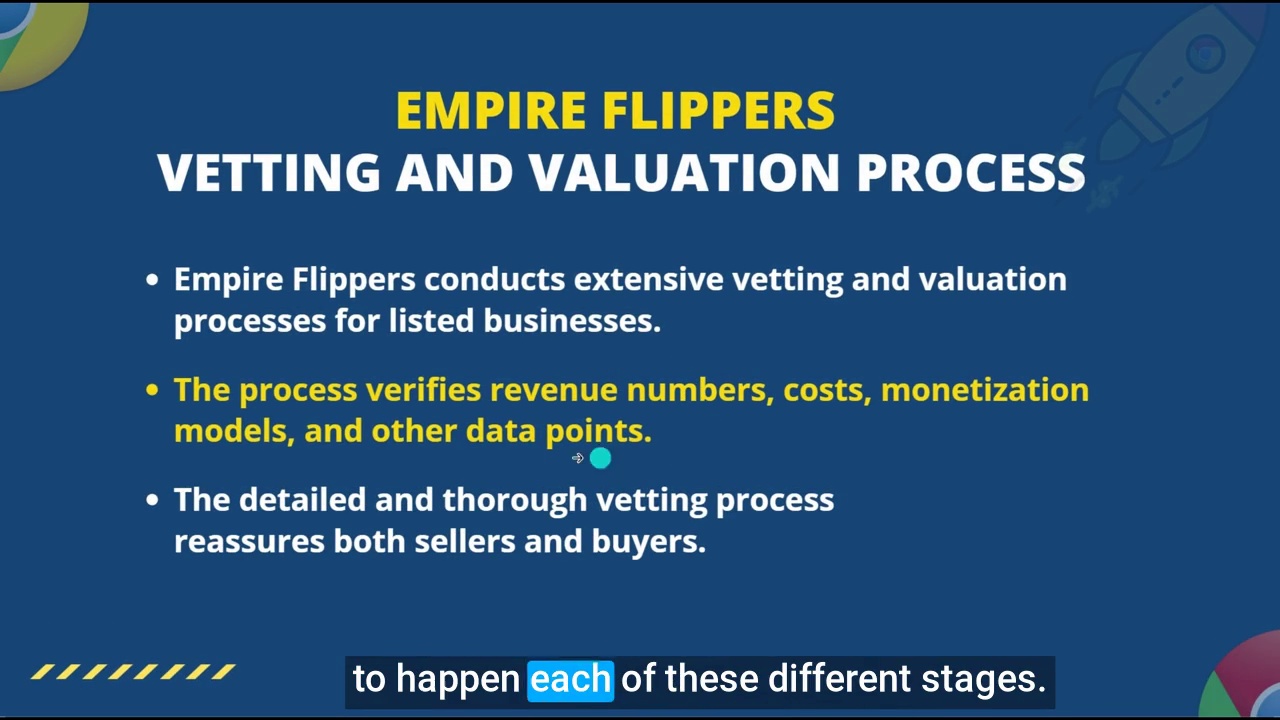

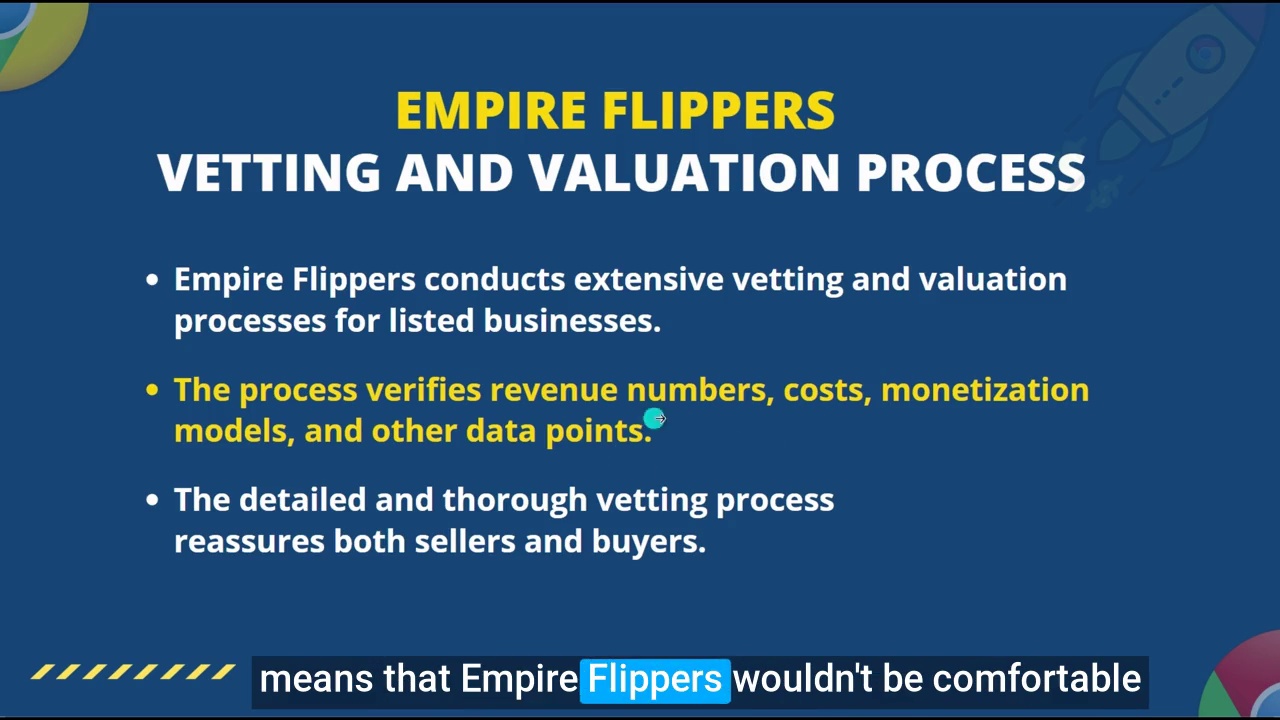

The selling process begins with vetting and valuation. Empire Flippers conducts extensive verification of revenue numbers, costs, and monetization models. They request stats, figures, and read-only access to accounts. Most businesses are rejected due to inflated numbers or false claims.

After submitting a listing, sellers provide identification and documentation. The final valuation is typically received within 1-2 weeks. Agreeing to the valuation is a legally binding commitment to sell at that price.

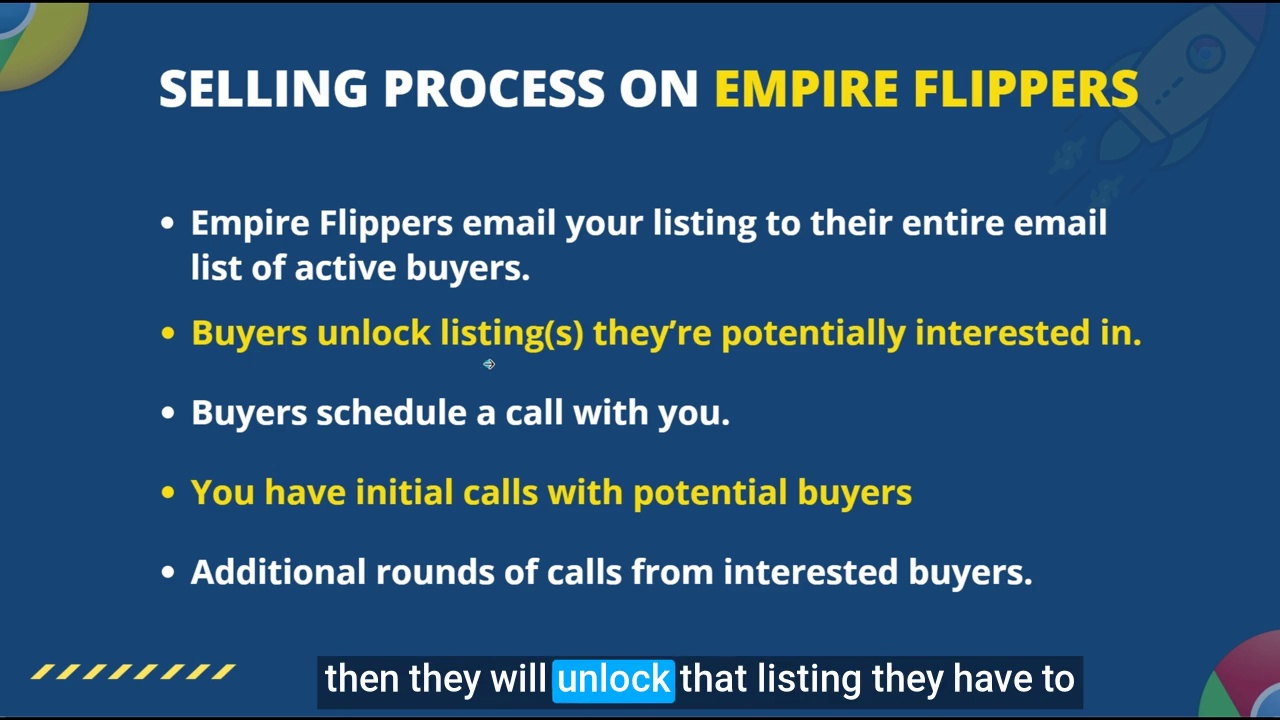

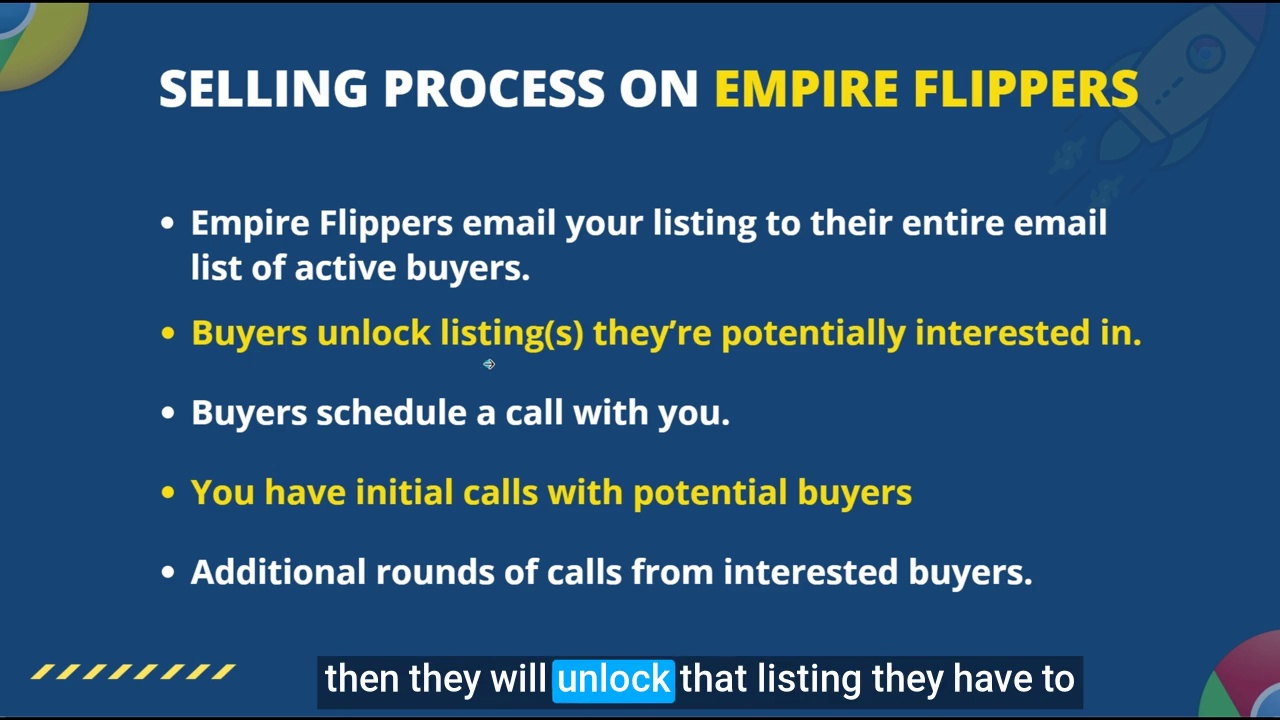

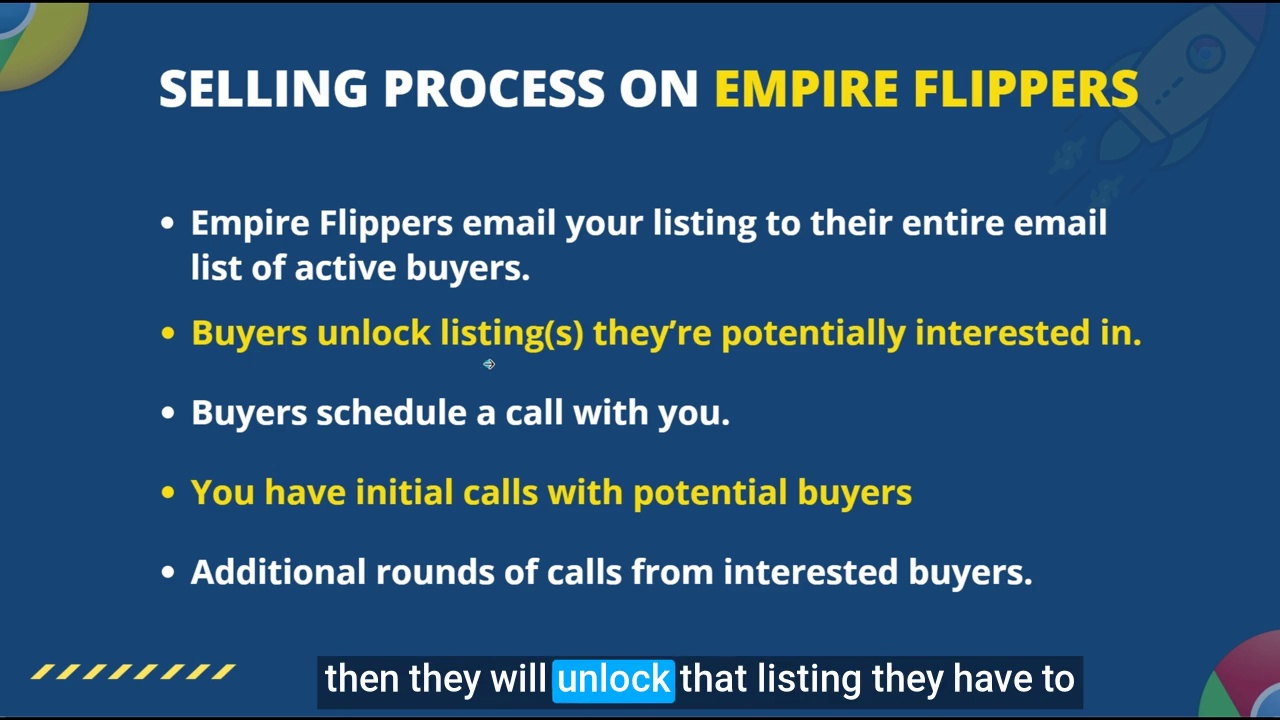

Listings go live on Mondays and are emailed to active buyers. Buyers must have verified liquid funds to unlock a listing. Calls are scheduled with Empire Flippers present. Offers are submitted, with negotiations typically focusing on deal terms rather than price.

Upon offer acceptance, a 10-20% holding deposit is paid to Empire Flippers. The listing becomes inactive, and the remainder of the payment is made before moving to the migration phase.

The narrator recommends Empire Flippers for their integrity and thorough process, considering them the go-to online business broker.

.https://fldmp.com/9Rick%20Blyth%20-%20Chrome-Ext/12-%20Exit/08-End%20To%20End%20Selling%20Process.mp4 - Part 2

The narrator discusses pre-sale optimizations to maximize business value before selling. Every $1,000 added to monthly net profit can increase sale price by $40,000 with a 40x multiplier. Most valuations examine the trailing 12 months of performance.

It's important to show upward trends in key performance indicators (KPIs). The narrator advises not to neglect the business while focusing on selling. Maintaining or improving revenue and controlling costs is crucial.

There's no guarantee of finding a buyer, so keeping the business profitable is essential. The narrator emphasizes the importance of continuing to run the business effectively during the sales process.

The next lesson will cover the end-to-end sales process.

.https://fldmp.com/9Rick%20Blyth%20-%20Chrome-Ext/12-%20Exit/08-End%20To%20End%20Selling%20Process.mp4 - Part 3

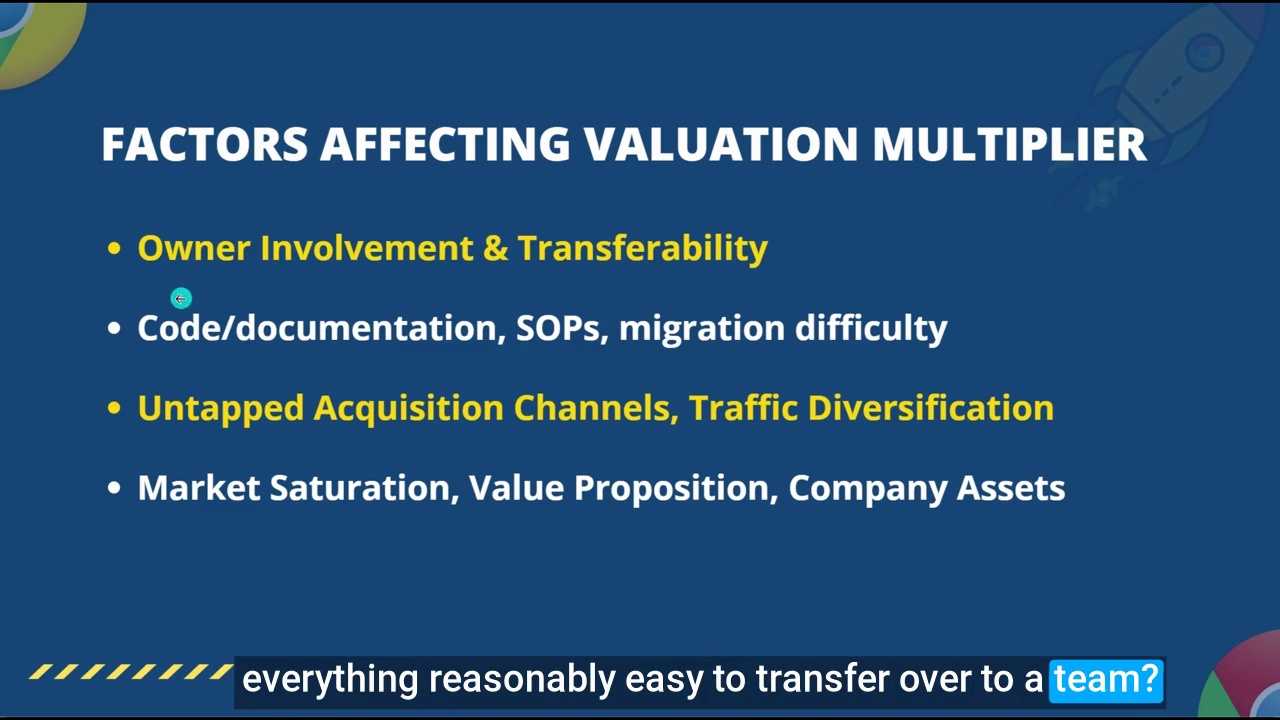

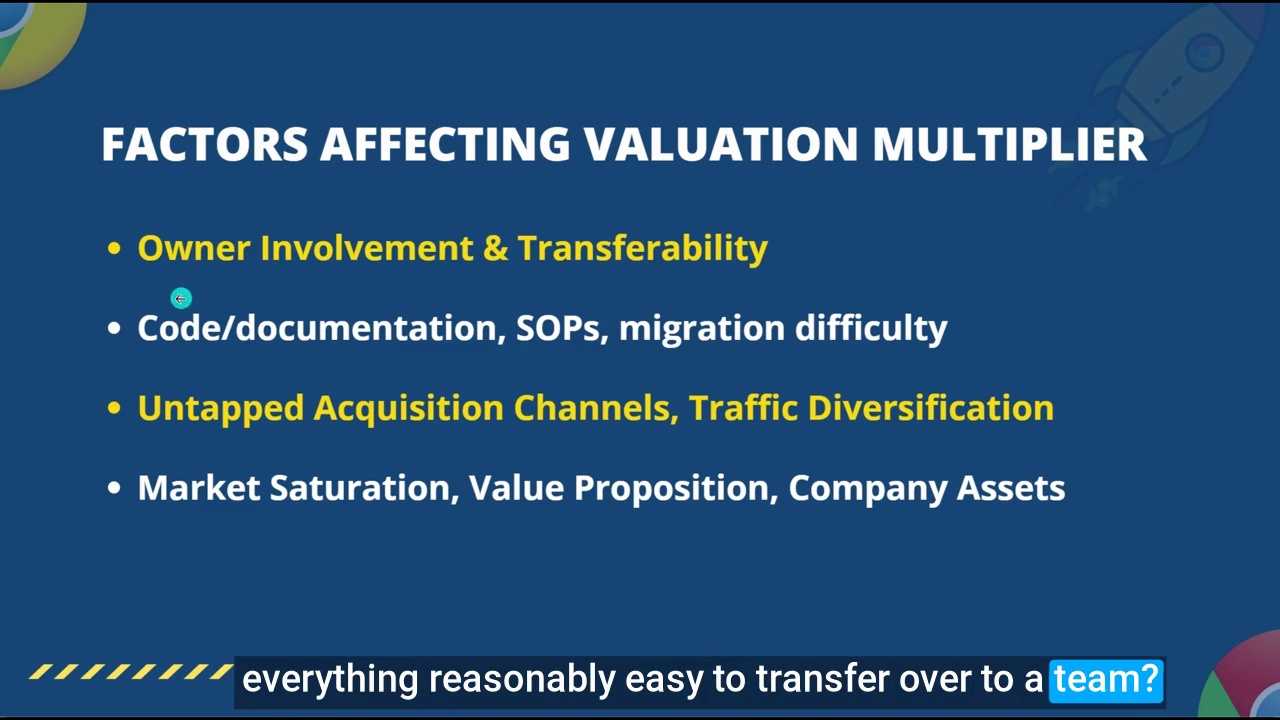

The narrator discusses factors affecting valuation multipliers for businesses. Key performance indicators like churn, customer lifetime value, and customer acquisition cost are important. Revenue streams, including monthly recurring revenue, annual revenue, and lifetime revenue, are considered.

Profit margin, business age, and market niche influence valuation. Businesses typically need at least two years of operation to attract buyers. Market trends, user base growth, and monthly profit increases are evaluated.

Owner involvement and transferability are assessed. Factors include reliance on the owner, ease of transfer, code documentation, and standard operating procedures. Untapped acquisition channels and traffic sources are examined.

Market saturation, competition, and value proposition are considered. Assets included in the sale, such as email lists, social media channels, and software, are evaluated. The narrator mentions including Merch by Amazon and KDP Amazon accounts in their sale.

Valuation multiples may vary between brokers due to the numerous factors involved. The narrator concludes by mentioning an upcoming lesson on pre-sale optimization strategies for Chrome extension businesses.

.https://fldmp.com/9Rick%20Blyth%20-%20Chrome-Ext/12-%20Exit/08-End%20To%20End%20Selling%20Process.mp4 - Part 4

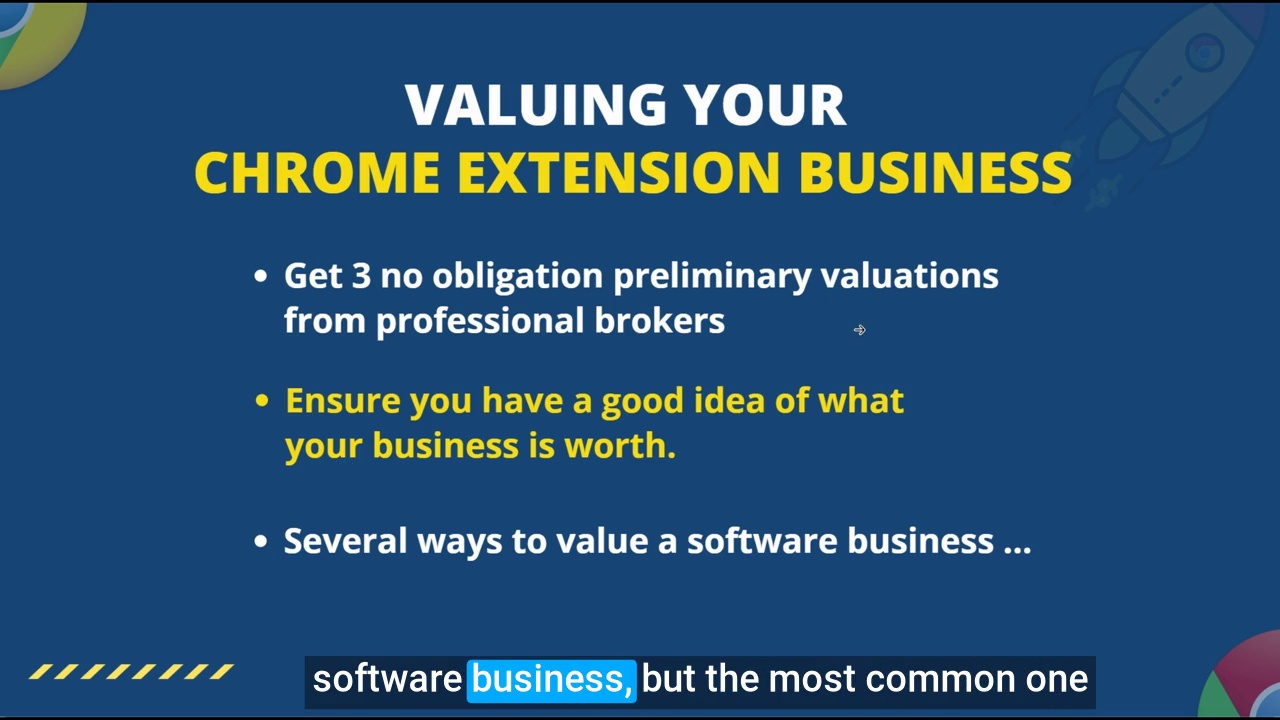

The narrator discusses valuing Chrome extension businesses. Online valuation tools can provide quick preliminary estimates based on key metrics. These tools offer a decent range, though not exact figures. The narrator's own business valuation fell in the middle of the range provided by such tools.

Free preliminary valuations from professional online brokers are recommended. The most common valuation method for software businesses is the standard formula: net profit times a valuation multiplier. An example is given: $10,000 monthly net profit with a multiplier of 40 results in a $400,000 valuation.

The valuation multiplier is crucial and influenced by various factors. Another valuation method is Seller's Discretionary Earnings (SDE), calculated as revenue minus cost of goods sold, expenses, and owner compensation. Some brokers may use the SDE formula instead of the standard one.

The narrator promises to discuss factors affecting the valuation multiplier in the next lesson.

.